As the founder of LEAD Ministries and an advocate for child rights, I feel compelled to raise urgent alarm about a disturbing global trend: the for

An Economic Drone Attack; By Mohammed Akmal pasha

Shakespeare said, ‘as butterflies to the wanton boys are we to gods, they kill us for their sport.’ The plight of the economy and its remnants speak volumes about economic drone attack albeit executed inadvertently as far as consequences are concerned. The gods, the wanton boys are vainglorious with respect to LDCs’ butterflies and flamboyant with respect to sport of drone attacks.

As is in vogue these days, we also perform the ritual of saying a word about budget 2009-10 which at large is a documented manifestation of our succumbing to IMF’s stratagems so as to justify US$7.6 billion emergency standby facility granted last November. Again, on behest of IMF’s screwing demand of raising tax revenue through the instruments primarily based upon increasing tax rate instead of widening tax base; we were to keep our fiscal deficit at 4.6 % of GDP. Now we have been given a liberty of taking it to 5.5% of GDP; hats off for the uprooted Swatis. The rationale for increased fiscal deficit is obviously the offshoot of the predicament of IDPs.

Now we come to the economic drone attack. Fathomed through a single variable that is the GDP growth rate of 2 %; the commensurately cascading indicators of the health of the economy cannot be assumed to be appeasing. Add to it the fact that the year 2008-09 was marked by a slowest GDP growth rate during the last decade; less than half of the original target.

Ironically speaking, it is heartening that the GDP growth rate still exceeds our population growth rate. In the light of the statistics of the Economic Survey for the year 2008-09, with a population growth at 1.9%, the 2% increase in real GDP indicates a surpass over population growth rate. For non-economists it may be incredible if per capita income still declined. The per capita income rose from $410 in 1999 to mighty $1,085 in 2007-8 that is 265 %. It has now fallen to $1,071 showing a 1 % decline instead of rise.

The other indicator of industriousness of our economic managers is the declining industrial growth rate. Instead of meeting its target of 6 %, our industrial sector shrank to 3.6% during the last year. However, amazingly enough, an equal growth rate was seen in services sector that is 3.6 %. It yet fell short and remained half of its target which originally equaled 6.1%. Exports ending June 30 stood at $19.5 billion against a target of $22.9 billion leaving a gap of almost 15 % ; are now expected to rise to $19.9 billion in coming year that is showing an increase of just 2 % over last year’s achievement. It was only agriculture that grew by 4.7% against last year’s 1.1% which surpassed its target of 3.5%. One may notice that it is a matter of common sense that positive sign of one sector can hardly make for the negativities of many other sectors unless it wholesomely exceeds all others or at least balances them altogether which is not the case here.

A heartening measure is that FBR's tax-to-GDP ratio which may touch 9% of GDP against the target of 10%. This effectuates in the hands of brutally raised levies to push the investors to the wall. The investors either succumb to this pushing or eventually break the wall and bestow upon the alien nations the benevolence of FDI that the investors carry. Probably the other way for the government was to keep GDP restrained so that a 9 % tax-to-GDP ratio could be attained! While levying taxes on telecom and electricity, the FBR must have kept in mind the tax elasticity and tax incidence. For the sake of our own revision, where tax elasticity measures the relationship between a 1 % increase in tax rate giving rise to some ‘x’ % increase in tax revenue; tax incidence measures the percentage of ultimate burden that falls on the tax payer. According to Mr. Tarin, "To maintain a sustained growth of 8% to 10%, tax revenue has to be in the range of 15% to 17% of GDP. However, the growth in this fiscal year will be around 2.5%.” Let us correct Mr. Tarin that economic growth might be a certainty, but it would never be a pro-poor growth!

As per statistics, two thirds of our revenue is usurped by debt servicing and defence expenditure collectively. Hence, the army remains major beneficiary of the war against the Taliban which very much legitimizes surge in defence expenditure to rise by 14.29 %. This happened during the last nine months compared with the statistics of the same period last year. This certainly or at least seemingly legitimizes (since the revenues squeeze) a shrink in development expenditures by 25%, that in turn legitimizes squeezing of fiscal deficit to 3% of GDP in the period. This would have been the trail of corollaries conceived by Mr. Tarin.

Yet the mischief of reducing development expenditures has its own economic implications which essentially mar rather degenerate economic sustainability of the country. Where current expenditures help meet running cost of governance, the development expenditures add to capital formation and establishment of long term productive assets and resources. In the process of their creation, they tend to create job opportunities and other linkages. The linkages may have two types that is; backward and forward. In other words economic activity accelerates through suppliers of raw material (backward linkages) and buyers of finished goods (forward linkages). As a result, employment and wages improve which culminate into better economic life of the masses. Once capital formation and assets take form, other phase of economic activity triggers which has similar advantages as stated above, but are more enduring. The objective of dishing out a bit of economics here is not didactic; rather intent here is to elaborate economic disadvantages of curtailing development expenditures which is the case in hand. There is another cost, as the government has declared Malakand a calamity-hit area and promised to declare all agricultural loans as bad debts (were they good ever?). It must be prepared to pacify more than 2 million claimants.

To conclude, economic planning, economic management and economic plight of the country manifests that there has been an economic drone attack which has ruined the economy. As in the case of military drone attack, the economic drone attack again is led by foreign hands. The scenario is similar and so are the consequences. ‘Gods are just and out of our follies, make instruments to plague us.’ (William Shakespeare)

As is in vogue these days, we also perform the ritual of saying a word about budget 2009-10 which at large is a documented manifestation of our succumbing to IMF’s stratagems so as to justify US$7.6 billion emergency standby facility granted last November. Again, on behest of IMF’s screwing demand of raising tax revenue through the instruments primarily based upon increasing tax rate instead of widening tax base; we were to keep our fiscal deficit at 4.6 % of GDP. Now we have been given a liberty of taking it to 5.5% of GDP; hats off for the uprooted Swatis. The rationale for increased fiscal deficit is obviously the offshoot of the predicament of IDPs.

Now we come to the economic drone attack. Fathomed through a single variable that is the GDP growth rate of 2 %; the commensurately cascading indicators of the health of the economy cannot be assumed to be appeasing. Add to it the fact that the year 2008-09 was marked by a slowest GDP growth rate during the last decade; less than half of the original target.

Ironically speaking, it is heartening that the GDP growth rate still exceeds our population growth rate. In the light of the statistics of the Economic Survey for the year 2008-09, with a population growth at 1.9%, the 2% increase in real GDP indicates a surpass over population growth rate. For non-economists it may be incredible if per capita income still declined. The per capita income rose from $410 in 1999 to mighty $1,085 in 2007-8 that is 265 %. It has now fallen to $1,071 showing a 1 % decline instead of rise.

The other indicator of industriousness of our economic managers is the declining industrial growth rate. Instead of meeting its target of 6 %, our industrial sector shrank to 3.6% during the last year. However, amazingly enough, an equal growth rate was seen in services sector that is 3.6 %. It yet fell short and remained half of its target which originally equaled 6.1%. Exports ending June 30 stood at $19.5 billion against a target of $22.9 billion leaving a gap of almost 15 % ; are now expected to rise to $19.9 billion in coming year that is showing an increase of just 2 % over last year’s achievement. It was only agriculture that grew by 4.7% against last year’s 1.1% which surpassed its target of 3.5%. One may notice that it is a matter of common sense that positive sign of one sector can hardly make for the negativities of many other sectors unless it wholesomely exceeds all others or at least balances them altogether which is not the case here.

A heartening measure is that FBR's tax-to-GDP ratio which may touch 9% of GDP against the target of 10%. This effectuates in the hands of brutally raised levies to push the investors to the wall. The investors either succumb to this pushing or eventually break the wall and bestow upon the alien nations the benevolence of FDI that the investors carry. Probably the other way for the government was to keep GDP restrained so that a 9 % tax-to-GDP ratio could be attained! While levying taxes on telecom and electricity, the FBR must have kept in mind the tax elasticity and tax incidence. For the sake of our own revision, where tax elasticity measures the relationship between a 1 % increase in tax rate giving rise to some ‘x’ % increase in tax revenue; tax incidence measures the percentage of ultimate burden that falls on the tax payer. According to Mr. Tarin, "To maintain a sustained growth of 8% to 10%, tax revenue has to be in the range of 15% to 17% of GDP. However, the growth in this fiscal year will be around 2.5%.” Let us correct Mr. Tarin that economic growth might be a certainty, but it would never be a pro-poor growth!

As per statistics, two thirds of our revenue is usurped by debt servicing and defence expenditure collectively. Hence, the army remains major beneficiary of the war against the Taliban which very much legitimizes surge in defence expenditure to rise by 14.29 %. This happened during the last nine months compared with the statistics of the same period last year. This certainly or at least seemingly legitimizes (since the revenues squeeze) a shrink in development expenditures by 25%, that in turn legitimizes squeezing of fiscal deficit to 3% of GDP in the period. This would have been the trail of corollaries conceived by Mr. Tarin.

Yet the mischief of reducing development expenditures has its own economic implications which essentially mar rather degenerate economic sustainability of the country. Where current expenditures help meet running cost of governance, the development expenditures add to capital formation and establishment of long term productive assets and resources. In the process of their creation, they tend to create job opportunities and other linkages. The linkages may have two types that is; backward and forward. In other words economic activity accelerates through suppliers of raw material (backward linkages) and buyers of finished goods (forward linkages). As a result, employment and wages improve which culminate into better economic life of the masses. Once capital formation and assets take form, other phase of economic activity triggers which has similar advantages as stated above, but are more enduring. The objective of dishing out a bit of economics here is not didactic; rather intent here is to elaborate economic disadvantages of curtailing development expenditures which is the case in hand. There is another cost, as the government has declared Malakand a calamity-hit area and promised to declare all agricultural loans as bad debts (were they good ever?). It must be prepared to pacify more than 2 million claimants.

To conclude, economic planning, economic management and economic plight of the country manifests that there has been an economic drone attack which has ruined the economy. As in the case of military drone attack, the economic drone attack again is led by foreign hands. The scenario is similar and so are the consequences. ‘Gods are just and out of our follies, make instruments to plague us.’ (William Shakespeare)

You May Also Like

Even before 2026 began, we were never on track to deliver on gender equality and human right to health and broader development justice. For e

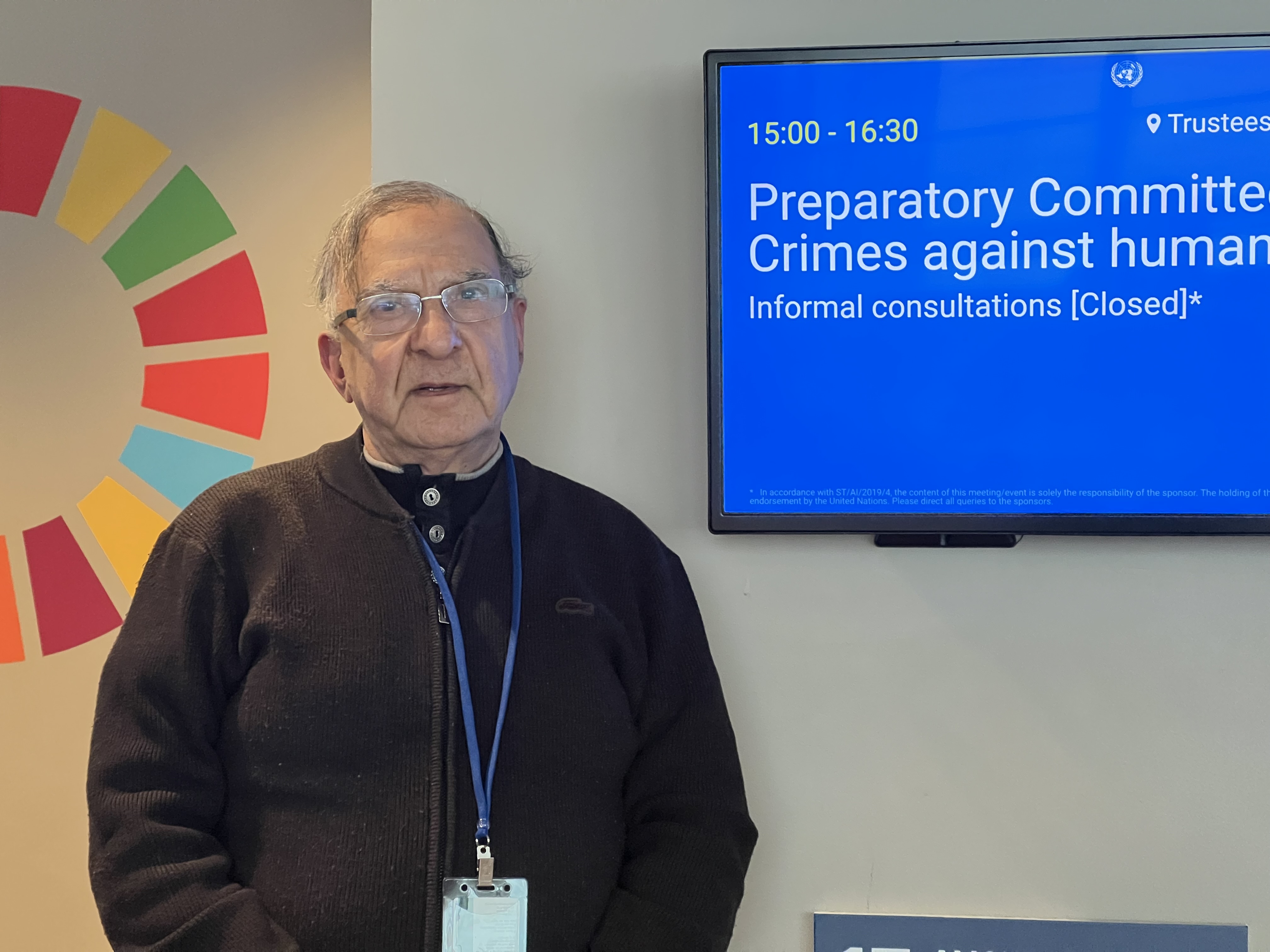

New York: Crimes against humanity represent one of the most serious affronts to human dignity and collective conscience. They embody patterns of wi

"Trial of Pakistani Christian Nation" By Nazir S Bhatti

On demand of our readers, I have decided to release E-Book version of "Trial of Pakistani Christian Nation" on website of PCP which can also be viewed on website of Pakistan Christian Congress www.pakistanchristiancongress.org . You can read chapter wise by clicking tab on left handside of PDF format of E-Book.